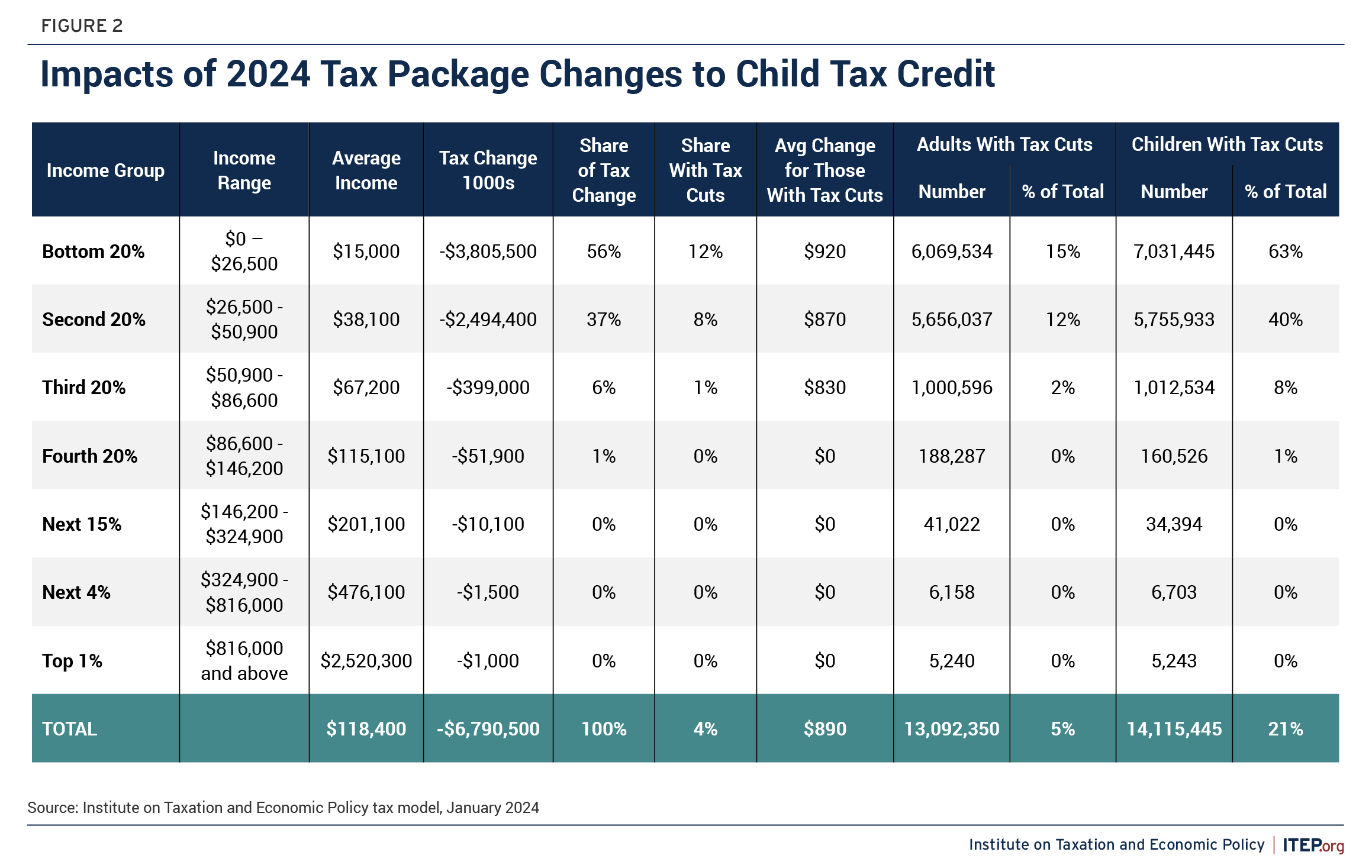

Retroactive Tax Credits 2024 Calculator – The proposed deal would increase the maximum refundable amount per child to $1,800 in tax year 2023, $1,900 in tax year 2024, and $2,000 in tax year 2025. Additionally, the maximum $2,000 child tax . Child tax credits are likely to be expanded thanks to a $78 billion tax agreement between the Democrat-led Senate Finance Committee and the Republican-helmed House Ways and Means Committee. .

Retroactive Tax Credits 2024 Calculator

Source : www.shrm.org

Town: Avoid penalties, pay taxes by Feb. 12 Bethpage Newsgram

Source : www.bethpagenewsgram.com

What is Retro Pay and How Does it Work? | Homebase

Source : joinhomebase.com

Report: Wealthy Michiganders pay lower taxes than everyone else

Source : michiganadvance.com

Product Trends: Opportunity of a Lifetime QUALIFIED REMODELER

Source : www.qualifiedremodeler.com

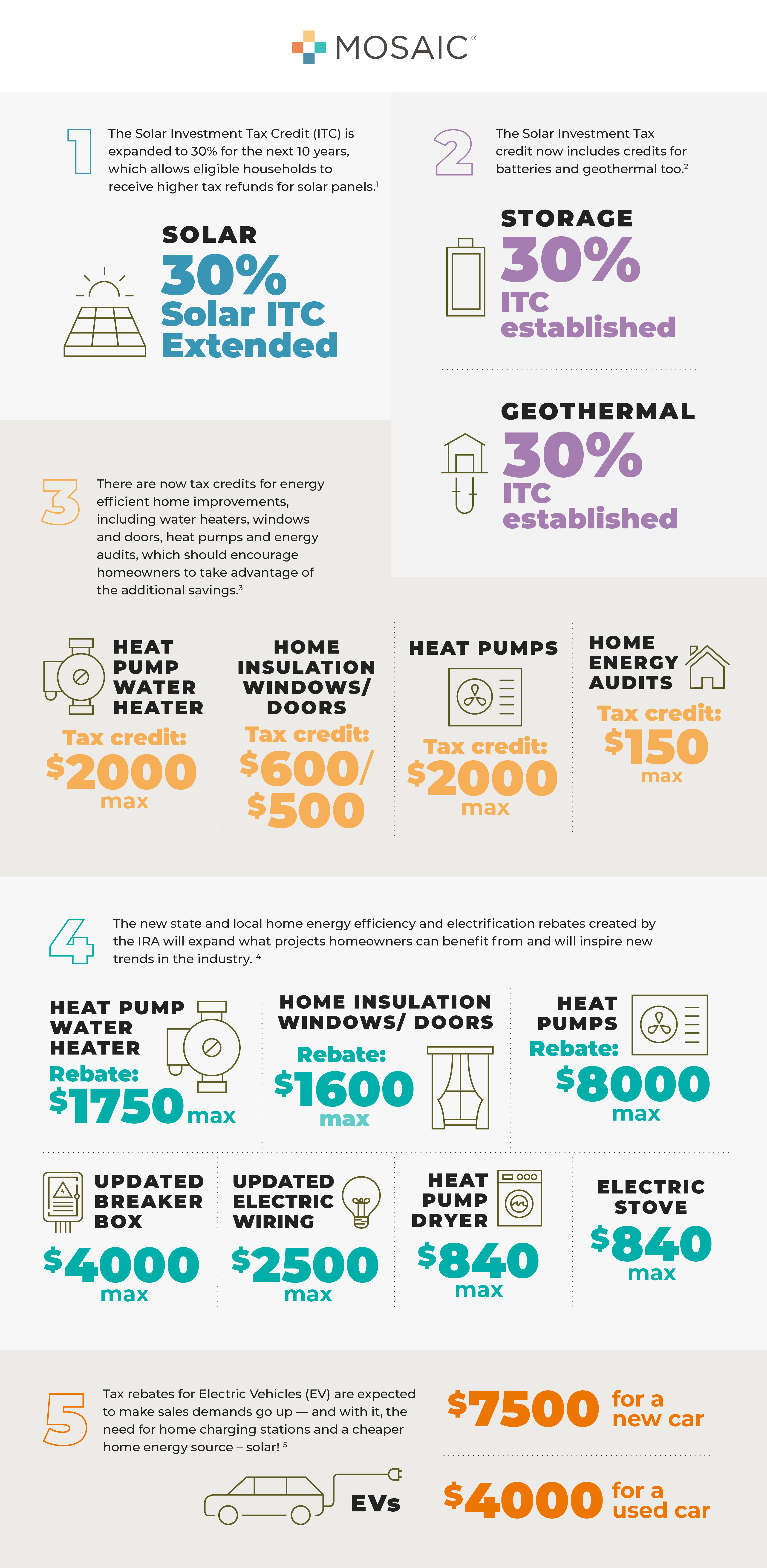

5 Ways The IRA Will Benefit Homeowners (and Contractors)

Source : joinmosaic.com

Town: Avoid penalties, pay taxes by Feb. 12 Mid Island Times

Source : www.midislandtimes.com

Proposed Tax Deal Would Help Millions of Kids with Child Tax

Source : itep.org

Federal Solar Tax Credit 2024: What It Is & How Does It Work

Source : www.freshbooks.com

Employee Retention Tax Credit Retroactively Terminated: What To Do

Source : anderscpa.com

Retroactive Tax Credits 2024 Calculator Retroactive Filing for Employee Retention Tax Credit Is Ongoing : The experts at Forbes Advisor have compiled our list of the 50 best places to travel in 2024—and the best credit cards and rewards you can use to make your travels even more unforgettable. . Opinions expressed by Forbes Contributors are their own. I write about how to maximize your automotive investment and more. As part of the highly-touted Inflation Reduction Act, Congress extended .